Last time I posted an article about exterior projects. So, I figured this time I should give you a link for interior projects. I really like these articles on cost vs value. It is a great tool for home owners as they are deciding which projects will give them the most bang for their buck.

Once again I was suprised at how low cost a couple of these projects are. If you are thinking of selling your home in the next year, you might consider taking on a couple of these projects. One of my favorite and accurate quotes this year concerning homes for sell is "It is a price war and a beauty contest out there". Some of these low cost projects could help you sell your home faster.

2009 Cost vs. Value Report: REALTOR® Magazine

A blog about local real estate and events in the Grand Junction, Fruita, and Mesa County Area.

Search This Blog

Sunday, December 27, 2009

Friday, December 18, 2009

Exterior Remodeling: Best Bang for Your Buck

I was really suprised at what projects will give you the most bang for your buck! I think you will be, as well!

REALTOR® Magazine-Daily News-Exterior Remodeling: Best Bang for Your Buck

REALTOR® Magazine-Daily News-Exterior Remodeling: Best Bang for Your Buck

Tuesday, November 24, 2009

Questions I'm Asked On A Daily Basis-Real Estate Market FAQs

The following article answers questions I'm asked on a daily basis. I have already given most of you the same answers that are in this article, but it never hurts to hear it again. Feel free to call me if you want more specific answers to our area or to find out the value of your home. Thanks!

REALTOR® Magazine-Daily News-Real Estate Market FAQs

REALTOR® Magazine-Daily News-Real Estate Market FAQs

Wednesday, November 18, 2009

Low Mortgage Rates Could Be Ending

I've been hearing about this for some time now! If you have an adjustable rate mortgage or are shopping for a home this is something to consider. Feel free to give me a call with any questions you might have. Thanks!

REALTOR® Magazine-Daily News-Low Mortgage Rates Could Be Ending

REALTOR® Magazine-Daily News-Low Mortgage Rates Could Be Ending

Friday, November 6, 2009

Whoot Whoot! - REALTOR® Magazine-Daily News-Both Houses OK Tax Credit Extension, Expansion

It is official! They extended the tax credit and added add a $6,500 tax credit for repeat buyers if they've lived in their home for five of the past eight years. You can get more information through the following link. Please give me a call if you have any questions!

REALTOR® Magazine-Daily News-Both Houses OK Tax Credit Extension, Expansion

REALTOR® Magazine-Daily News-Both Houses OK Tax Credit Extension, Expansion

Is It Worth the Risk? - REALTOR® Magazine-Daily News-5 Steps to Financing a Sale

This option is without a doubt, at least in my mind, a last resort. However, that being said, there are times when this is the only viable option. One example would be a mobile home built prior to 1978 that won't qualify for a FHA or conventional loan. I do have a word of warning for any sellers out there considering an owner carry loan. Usually the buyers are interested in this option because the bank is unwilling to loan them the money, and the reasons for this can vary from bad/insufficient credit to criminal history. My advice to you is seller BEWARE!

REALTOR® Magazine-Daily News-5 Steps to Financing a Sale

REALTOR® Magazine-Daily News-5 Steps to Financing a Sale

Wednesday, November 4, 2009

REALTOR® Magazine-Daily News-Pinching Pennies on Construction

The Following link has some interesting ways to cut cost when building a new home. I'm willing to bet a few of you out there have some suggestions of your own. I would love to hear them. Don't be shy!

REALTOR® Magazine-Daily News-Pinching Pennies on Construction

REALTOR® Magazine-Daily News-Pinching Pennies on Construction

Friday, October 30, 2009

Good News...Good News! - REALTOR® Magazine-Daily News-Homebuyer Credit Gets New Life

Boy was this music to my ears! I had buyers that had decided to try to save the money on buying a home and possibly miss out on the tax credit. I'm guessing they are doing a little jig, right now. Check out the following link!This decision definitely gives the buyers out there a bit of breathing room and they won't feel so pressured to buy a home before Nov. 30th. The buyers can make sure they are buying the home that is right for them and their future.

Also, did you notice that current homeowners have an opportunity for a tax credit. They are eligible for a $6,500 tax credit if they have lived in their current residence for a consecutive five-year period in the past eight years. Is this music to your ears?

REALTOR® Magazine-Daily News-Homebuyer Credit Gets New Life

Also, did you notice that current homeowners have an opportunity for a tax credit. They are eligible for a $6,500 tax credit if they have lived in their current residence for a consecutive five-year period in the past eight years. Is this music to your ears?

REALTOR® Magazine-Daily News-Homebuyer Credit Gets New Life

Monday, October 12, 2009

$8,000 Tax Credit Nears End

This is a great article that is easy to read-

The government is offering an $8,000 tax credit for first-time homebuyers - that is, folks who haven't owned a home during the past three years. According to the plan, first-time homebuyers who purchase a home may be eligible for the lower of an $8,000 or 10% of the value of the home tax credit.

However, the program is scheduled to end soon. In fact, the Internal Revenue Service recently reminded potential first-time buyers that they must complete their first-time home purchases before December 1, 2009 to qualify for the special credit, which means the last day to close on a home and qualify for the credit is November 30, 2009. In other words, right now is the time to take advantage of this opportunity.

Here's some information to help you understand what the tax credit benefits are and who qualifies.

Benefits of the Tax Credit

It's important to remember that the $8,000 tax credit is just that... a tax credit. It's a dollar-for-dollar tax reduction, rather than a reduction in a tax liability that would only save you $1,000 to $1,500 when all was said and done. So, if you were to owe $8,000 in income taxes and would qualify for the $8,000 tax credit, you would owe nothing.

Better still, the incentive is refundable, which means you can receive a check for the credit even if you have little income tax liability. For example, if you're liable for $4,000 in income tax, you can offset that $4,000 with half of the tax incentive... and still receive a check for the remaining $4,000!

Who Qualifies?

The $8,000 incentive starts phasing out for couples with incomes above $150,000 and single filers with incomes above $75,000 and is phased out completely at incomes of $170,000 for couples and $95,000 for single filers. To break down what this phase-out means, the National Association of Homebuilders (NAHB) offers the following examples:

Example 1: Assume that a married couple has a modified adjusted gross income of $160,000. The applicable phase-out threshold is $150,000, and the couple is $10,000 over this amount. Dividing $10,000 by $20,000 yields 0.5. When you subtract 0.5 from 1.0, the result is 0.5. To determine the amount of the partial first-time homebuyer incentive to this couple, multiply $8,000 by 0.5. The result is $4,000.

Example 2: Assume that an individual homebuyer has a modified adjusted gross income of $88,000. The buyer's income exceeds $75,000 by $13,000. Dividing $13,000 by $20,000 yields 0.65. When you subtract 0.65 from 1.0, the result is 0.35. Multiplying $8,000 by 0.35 shows that the buyer is eligible to reduce the tax liability by $2,800.

Remember, these are general examples. Borrowers should consult a tax advisor to provide guidance relevant to their specific circumstances.

What Type of Home Qualifies?

The tax credit is applicable to any home that will be used as a principal residence. Based on that guideline, qualifying "homes" include single-family detached homes, as well as attached homes such as townhouses and condominiums. In addition, manufactured homes and houseboats used for principal residence also qualify. Buyers will have to repay the credit if they sell their homes within three years.

I don't want anyone to miss an opportunity by either waiting or misunderstanding the media headlines. Let's talk further on this. Call or email me, and let's discuss what this might mean for you.

The material contained in this newsletter has been prepared by an independent third-party provider. The material provided is for informational and educational purposes only and should not be construed as investment, financial, real estate and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is not without errors.

As your Trusted Advisor, I always want to make sure you are clear on all details of the home financing process. If you or someone you know are interested in purchasing or refinancing a home, give me a call today! Laura Holm

Mortgage Success Source, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Success Source, LLC does not grant to the recipient or distributor a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

The government is offering an $8,000 tax credit for first-time homebuyers - that is, folks who haven't owned a home during the past three years. According to the plan, first-time homebuyers who purchase a home may be eligible for the lower of an $8,000 or 10% of the value of the home tax credit.

However, the program is scheduled to end soon. In fact, the Internal Revenue Service recently reminded potential first-time buyers that they must complete their first-time home purchases before December 1, 2009 to qualify for the special credit, which means the last day to close on a home and qualify for the credit is November 30, 2009. In other words, right now is the time to take advantage of this opportunity.

Here's some information to help you understand what the tax credit benefits are and who qualifies.

Benefits of the Tax Credit

It's important to remember that the $8,000 tax credit is just that... a tax credit. It's a dollar-for-dollar tax reduction, rather than a reduction in a tax liability that would only save you $1,000 to $1,500 when all was said and done. So, if you were to owe $8,000 in income taxes and would qualify for the $8,000 tax credit, you would owe nothing.

Better still, the incentive is refundable, which means you can receive a check for the credit even if you have little income tax liability. For example, if you're liable for $4,000 in income tax, you can offset that $4,000 with half of the tax incentive... and still receive a check for the remaining $4,000!

Who Qualifies?

The $8,000 incentive starts phasing out for couples with incomes above $150,000 and single filers with incomes above $75,000 and is phased out completely at incomes of $170,000 for couples and $95,000 for single filers. To break down what this phase-out means, the National Association of Homebuilders (NAHB) offers the following examples:

Example 1: Assume that a married couple has a modified adjusted gross income of $160,000. The applicable phase-out threshold is $150,000, and the couple is $10,000 over this amount. Dividing $10,000 by $20,000 yields 0.5. When you subtract 0.5 from 1.0, the result is 0.5. To determine the amount of the partial first-time homebuyer incentive to this couple, multiply $8,000 by 0.5. The result is $4,000.

Example 2: Assume that an individual homebuyer has a modified adjusted gross income of $88,000. The buyer's income exceeds $75,000 by $13,000. Dividing $13,000 by $20,000 yields 0.65. When you subtract 0.65 from 1.0, the result is 0.35. Multiplying $8,000 by 0.35 shows that the buyer is eligible to reduce the tax liability by $2,800.

Remember, these are general examples. Borrowers should consult a tax advisor to provide guidance relevant to their specific circumstances.

What Type of Home Qualifies?

The tax credit is applicable to any home that will be used as a principal residence. Based on that guideline, qualifying "homes" include single-family detached homes, as well as attached homes such as townhouses and condominiums. In addition, manufactured homes and houseboats used for principal residence also qualify. Buyers will have to repay the credit if they sell their homes within three years.

I don't want anyone to miss an opportunity by either waiting or misunderstanding the media headlines. Let's talk further on this. Call or email me, and let's discuss what this might mean for you.

The material contained in this newsletter has been prepared by an independent third-party provider. The material provided is for informational and educational purposes only and should not be construed as investment, financial, real estate and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is not without errors.

As your Trusted Advisor, I always want to make sure you are clear on all details of the home financing process. If you or someone you know are interested in purchasing or refinancing a home, give me a call today! Laura Holm

Mortgage Success Source, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Success Source, LLC does not grant to the recipient or distributor a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

Saturday, October 10, 2009

Foreclosure Deal Vs Tax Credit

This question was emailed to me today and I thought it was a great question-

- Do to the increase of Foreclosures increasingForeclosure if we be patient are we more apt to save more than the $8000 tax credit. Are there better deals yet to come or has the market hit the bottom? and a link to this article was included - Foreclosure rate more than triples in Mesa County

Let me just start by saying "If anyone out there has a crystal ball I could borrow, I would greatly appreciate it. Please, Please, Pretty Please!!!"

I replied with the following:

- The only reason that I can foresee as to why you wouldn’t get the tax credit is if you both made over $150,000 combined, and from there my understanding is that you will get a percentage of the tax credit. Your accountant could answer that question better than me and trust me he has been asked many times. You can view the specifics for the 1st Time Homebuyer Tax Credit here. Also, did you read this article from the Daily Sentinel yesterday( This is a very good article) - Bargains to be found in housing market? Another factor that you might not be considering is the interest rate. The Government has been purchasing mortgage bonds and they have recently announced that they are going to start tapering off from purchasing them. As this continues to happen there is a good chance the interest rate will increase. I have a very informative newsletter that I will forward to you (See my previous post, below).

Now as far as the foreclosure rate is concerned, you need to remember that most of these short sales are home owners who are trying to sell their homes and lose less money and hopefully avoid foreclosure. Therefore, a lot of those homes they are predicting as foreclosures are already on the market or the owners are in the process of working out something with their banks (aka “Making Home Affordable”) Some of them have already been given the 90 day notice and some of them are either behind or almost behind on their mortgage payments and they are trying to get their home sold in order to avoid foreclosure. As we have seen, some of the sellers out there are making their payments, but can’t sell their home for less than they owe. Yes, if these short sale owners don’t sell their homes, there is a good chance they will get foreclosed on. Here is the thing to know. If they are actively trying to sell their home the bank will sometimes give them a break and allow them to become more than 3 months behind on their payments. Each foreclosure costs the banks a significant amount of money and they try to avoid spending it. Keep in mind that while all of this is happening the 1st lienholder has gotten an appraisal done and has a very good idea of what the home is worth. Therefore, before they agree to a short sale or sale it at foreclosure they know the homes value and each bank has their own formula of how much they will accept below the appraised value.

My opinion on all this is that some of these short sales out there are pretty good deals. The market price on average is lower than it has been in a couple of years and these short sell homes have the owners and the banks willing to take some good deals. The home owners just want to be done and the banks want to avoid paying the thousands of dollars to go through the foreclosure process. There is a down side, and that is a short sale can take up to 90-120 days (some don’t take that long, it varies) to be approved. It can be hard to be patient during this time. If someone comes in with a higher offer before the bank reviews your offer, their offer may be considered as well. Unless they extend the tax credit you will miss out on it, but you may have saved more in the process. I hope this has answered some of your questions, let me know if you have any more. Thanks!

Friday, October 9, 2009

Mortgage Interest Rates- Avoid This Costly Mistake

The following article came my way and I found this news very interesting. This Article was sent to me in a enewsletter from a Bank of America lender.

Avoid This Costly Mistake

If you've been following the financial news, you've probably heard that the Fed's been buying Mortgage Backed Securities. Unfortunately, people have picked up on the news and mistakenly discussed how these purchases will continue to cause rates to drop lower. But is that really what it means? No.

The following information can help set the record straight and help you make smart decisions that lead to a low interest rate for your home loan.

How is the Fed's Bond Purchase Related to Rates?

The Fed has been buying Mortgage Bonds. BUT... more precisely, they're buying a lot of FNMA 30-yr 5.0% and 5.5% Bonds. Many of the mortgages in these pools are outstanding home loans with rates between 6.0% and 6.5%, as the rate that a borrower pays is different than the coupon rate given to an investor buying into that mortgage pool, with the difference being taken by Wall Street firms and government agencies. The loans in these pools are likely to be refinanced and paid - because current rates make it very attractive to refinance a loan over 6.0%. Thus, giving the Fed a quick recoup on some of its investment.

Bottom line: The Fed's purchase of higher rate coupons will not necessarily help rates to move lower, as their actions do not impact the loans being originated at today's low rates.

The Problem Is...

Many consumers are in situations where they can refinance now and save hundreds of dollars a month on their mortgage payments. But if they hear people throwing around teases of lower rates ahead, they may decide to hold off on making the decision to save, in the hopes of gaining a few more dollars of savings per month if a lower rate came their way. Of course, while they're waiting, rates could turn higher - especially when you consider that the Fed is scaling back its purchases of Mortgage Backed Securities - and this window of opportunity could pass them by entirely.

Is the Fed Scaling Back? And What Will It Mean to Rates?

Last week, the New York Fed began to scale back their Mortgage Backed Security purchase program. The Fed has been buying about $25 Billion worth of Mortgage Backed Securities per week, but the new plan to drag out these purchases over a longer period of time means that they will be reducing both the frequency and amounts of their purchases. This will cause higher levels of volatility, as the Fed will be purchasing less often and less consistently. As a result, rates will probably rise gradually over time.

Here's the Clincher

Even if consumers are ultimately able to time the market perfectly and save another few bucks per month, they could still end up losing. That's because while they delayed, they lost the savings each month they could have gained by taking action sooner. In other words, they may have lost hundreds of dollars for every month they waited. So even if they got lucky and obtained the rate they were looking for, it could take years to make up what they lost by waiting.

I don't want anyone to miss an opportunity by either waiting or misunderstanding the media headlines. Let's talk further on this. Call or email me, and let's discuss what this might mean for you.

The material contained in this newsletter has been prepared by an independent third-party provider. The material provided is for informational and educational purposes only and should not be construed as investment, financial, real estate and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is not without errors.

As your Trusted Advisor, I always want to make sure you are clear on all details of the home financing process. If you or someone you know are interested in purchasing or refinancing a home, give me a call today!

Mortgage Success Source, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Success Source, LLC does not grant to the recipient or distributor a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

Avoid This Costly Mistake

If you've been following the financial news, you've probably heard that the Fed's been buying Mortgage Backed Securities. Unfortunately, people have picked up on the news and mistakenly discussed how these purchases will continue to cause rates to drop lower. But is that really what it means? No.

The following information can help set the record straight and help you make smart decisions that lead to a low interest rate for your home loan.

How is the Fed's Bond Purchase Related to Rates?

The Fed has been buying Mortgage Bonds. BUT... more precisely, they're buying a lot of FNMA 30-yr 5.0% and 5.5% Bonds. Many of the mortgages in these pools are outstanding home loans with rates between 6.0% and 6.5%, as the rate that a borrower pays is different than the coupon rate given to an investor buying into that mortgage pool, with the difference being taken by Wall Street firms and government agencies. The loans in these pools are likely to be refinanced and paid - because current rates make it very attractive to refinance a loan over 6.0%. Thus, giving the Fed a quick recoup on some of its investment.

Bottom line: The Fed's purchase of higher rate coupons will not necessarily help rates to move lower, as their actions do not impact the loans being originated at today's low rates.

The Problem Is...

Many consumers are in situations where they can refinance now and save hundreds of dollars a month on their mortgage payments. But if they hear people throwing around teases of lower rates ahead, they may decide to hold off on making the decision to save, in the hopes of gaining a few more dollars of savings per month if a lower rate came their way. Of course, while they're waiting, rates could turn higher - especially when you consider that the Fed is scaling back its purchases of Mortgage Backed Securities - and this window of opportunity could pass them by entirely.

Is the Fed Scaling Back? And What Will It Mean to Rates?

Last week, the New York Fed began to scale back their Mortgage Backed Security purchase program. The Fed has been buying about $25 Billion worth of Mortgage Backed Securities per week, but the new plan to drag out these purchases over a longer period of time means that they will be reducing both the frequency and amounts of their purchases. This will cause higher levels of volatility, as the Fed will be purchasing less often and less consistently. As a result, rates will probably rise gradually over time.

Here's the Clincher

Even if consumers are ultimately able to time the market perfectly and save another few bucks per month, they could still end up losing. That's because while they delayed, they lost the savings each month they could have gained by taking action sooner. In other words, they may have lost hundreds of dollars for every month they waited. So even if they got lucky and obtained the rate they were looking for, it could take years to make up what they lost by waiting.

I don't want anyone to miss an opportunity by either waiting or misunderstanding the media headlines. Let's talk further on this. Call or email me, and let's discuss what this might mean for you.

The material contained in this newsletter has been prepared by an independent third-party provider. The material provided is for informational and educational purposes only and should not be construed as investment, financial, real estate and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is not without errors.

As your Trusted Advisor, I always want to make sure you are clear on all details of the home financing process. If you or someone you know are interested in purchasing or refinancing a home, give me a call today!

Mortgage Success Source, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Success Source, LLC does not grant to the recipient or distributor a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

Wednesday, September 30, 2009

REALTOR® Magazine-Daily News-Cloudy Future for Solar Power

I've had a couple of friends do this and they love seeing their meter run backwards! In Grand Junction we have a lot of homes with hot water baseboard heat and evaporative coolers. The solar saves more money on homes with condensed air conditioning and forced air heating.

REALTOR® Magazine-Daily News-Cloudy Future for Solar Power

Shared via AddThis

REALTOR® Magazine-Daily News-Cloudy Future for Solar Power

Shared via AddThis

Friday, September 25, 2009

REALTOR® Magazine-Daily News-How to Beat the Tax Credit Deadline

This article holds some very good tips for 1st time home buyers. One of the things I've been running into lately, is that there are some homes in a short sale situation that are a really good deals. Unfortunatly, depending on where the sellers are in the process, there is a good chance that despite your best efforts the bank will take too long to get their ducks in a row and you will miss out on the tax credit. The banks are overwhelmed and it isn't unusual to submit an offer and have to wait 60-120 days or longer to hear if the bank will accept the offer.

Click here to read REALTOR® Magazine-Daily News-How to Beat the Tax Credit Deadline

Shared via AddThis

Click here to read REALTOR® Magazine-Daily News-How to Beat the Tax Credit Deadline

Shared via AddThis

Monday, September 14, 2009

Wednesday, September 9, 2009

Monday, August 24, 2009

My Favorite Quote....

....from this article is "It is like going to the mall and everything is on sale." Between the great prices and the $8,000 tax credit there are deals to be made. I'm trying to figure out how I can get the tax credit! I enjoy free money. I enjoyed the following article in that was in our local paper yesterday.

Click Here to read-First-time homebuyers find warm, cozy market-Daily Sentinel Article

Check it Out!!

Click Here to read-First-time homebuyers find warm, cozy market-Daily Sentinel Article

Check it Out!!

Friday, August 14, 2009

Mesa County Real Estate Trends For Last 20 Years

Let me just start by saying....be prepared to be surprised. The following graphs show how many homes have sold each year in the last 20 years. It is definitely an eye opener. That being said I think we need to learn from our history. If I had a penny for every time one of my parents said.."I should have bought that home on the corner back in '85. It was a HUD home priced for $75,000 and it just sold for $250,000 last month" or "Back in '85 that home was going for $65,000 and my payment would have been around $500 a month. I never really liked it much for me, but he is getting $1300 a month for rent on that thing, now." As we watch these homes come on the market and the asking prices dropping, this is a great time to invest in our future. Just remember to make sure it will cash flow (pay for itself) today. Graphs were provided by Heritage Title Company.

Tuesday, August 11, 2009

REALTOR® Magazine-Daily News-Census Trend: Fewer Owners, More Renters

While I was reading this, I couldn't help but think...It is a great time to start looking for investment property.

REALTOR Magazine-Daily News-Census Trend: Fewer Owners, More Renters

Shared via AddThis

REALTOR Magazine-Daily News-Census Trend: Fewer Owners, More Renters

Shared via AddThis

Wednesday, August 5, 2009

REALTOR® Magazine-Daily News-Uptrend Continues in Pending Home Sales

The following link includes statistics for regional areas. The good news that all regional areas showed an increase, Although some area home sales increased more than others. Also, if you haven't owned a home in the last 3 years, you may qualify for the $8,000 tax credit. In order to take advantage of this credit you need to close on your new home before Dec. 1, 2009. Feel free to call me if you have any questions. Thanks!

REALTOR® Magazine-Daily News-Uptrend Continues in Pending Home Sales

Shared via AddThis

REALTOR® Magazine-Daily News-Uptrend Continues in Pending Home Sales

Shared via AddThis

Monday, August 3, 2009

REALTOR® Magazine-Daily News-6 Reasons Why Some Homes Sell

In this competetive market you want to make sure your home has the edge. Are any of these reasons hindering you from selling you home?

REALTOR® Magazine-Daily News-6 Reasons Why Some Homes Sell

Shared via AddThis

REALTOR® Magazine-Daily News-6 Reasons Why Some Homes Sell

Shared via AddThis

Tuesday, July 14, 2009

The 2009 First-Time Home Buyer Tax Credit: The Basics for REALTORS, Homebuyers, and Home owners from the National Association of REALTORS.

The following link answers the most frequently asked questions I get about the $8,000 Tax Credit. If you have any more questions, Give me a call!

The 2009 First-Time Home Buyer Tax Credit: The Basics for REALTORS, Homebuyers, and Home owners from the National Association of REALTORS.

Shared via AddThis

The 2009 First-Time Home Buyer Tax Credit: The Basics for REALTORS, Homebuyers, and Home owners from the National Association of REALTORS.

Shared via AddThis

Monday, June 29, 2009

I Don't Think I Did Too Bad...

About 2 months ago (before I switched over to Coldwell Banker), Colorado Homes and Lifestyles Magazine called me and asked me for an interview concerning the real estate market in Colorado, specifically the western slope. I didn't know if anything would come of it, but for those of you that are interested (Thanks Mom!) you can check it our here. My little blurb is on bottom right hand corner of page 54 in the May 2009. Also, they show some homes from the upper-prices ranges available in Grand Junction and we come out looking pretty good!

Friday, June 26, 2009

For Those of You Who Don't Know.......

I've moved offices and I'm now with Coldwell Banker!!!! I'm very excited about this move! Change is always a bit scary, but the more I find out about my new company, the more excited I get. It is so refreshing to be with a company that is interested and investing in my success as a Real Estate Agent. This in turn makes me a better Realtor. With the tools I have at my disposal I can serve you better and sell your home faster.

Friday, April 24, 2009

Yeah! Some Good News

The Daily Sentinel recently posted the following article. There has been talk around the office about how things were picking up and I am happy to report we aren't the only ones.

Daily Sentinel Article - Grand Junction Home Market Responding to rates, Stimulis

Daily Sentinel Article - Grand Junction Home Market Responding to rates, Stimulis

Friday, March 27, 2009

Graphs-Grand Junction Real Estate Statistics for February 2009

For February things were still slow, but better. Homes sales increased from 68 to 109 for the entire MLS(Multiple Listing Service). Things are looking a little better for March, however I don't think the volume will come close when compared to the last two years. There was a huge discount in the $300 K -$400 K price range and that is due to one home taking a $53,000 discount. I am seeing the prices coming down on the homes that haven't been updated and if you are willing to do the work some of these homes are great deals.

Saturday, March 7, 2009

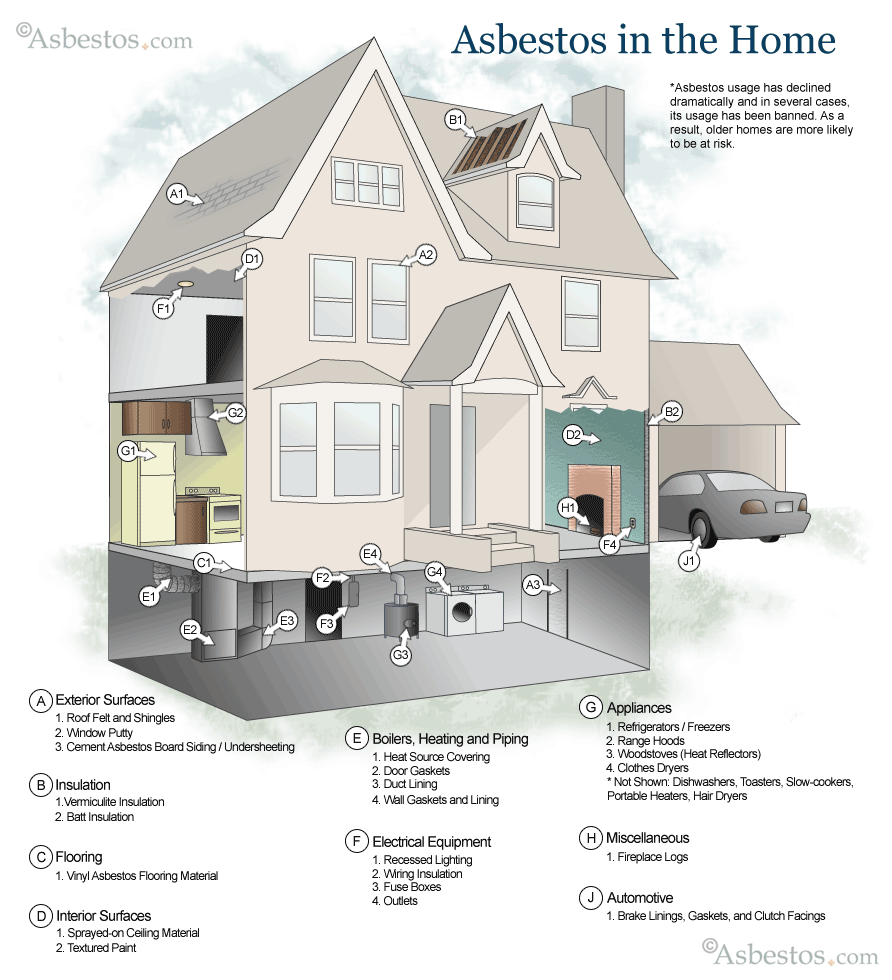

Asbestos-What You Need to Know Before Purchasing Your Home

I got a call the other day from someone who was reading my blog and asking about Asbestos in Mesa County. When buying a new home this is something to consider and there are radon inspectors just for this purpose. Asbestos (or Mill Tailings) has a history here in the Grand Valley that not everyone is aware of. While some of the homes were remedied of asbestos in the early 80's there are some homes that still have it. Also, for those folks out there that don't think you need to worry about it in the newer homes. Have I got news for you, last year a brand new home tested with higher than normal levels of radon. The stemwall foundation needed more ventilation and the radon was coming up through the crawl space. Luckily this was easy to fix. For those of you who don't know what asbestos is, I have included a diagram with helpful information and some links on the history of Asbestos in the Grand Junction Area. Your home may have already been tested. For a small fee you can call the Health Department at 970-248-7164 and they will give you a report(it may take a couple of days). Also, when buying a new home this is something you should do as part of the inspection process.

Uranium Mill Tailings Management Plan For Western Colorado

Mesa County Health Department Asbestos Website with Definition

_____________________________________________________

Uranium Mill Tailings Management Plan For Western Colorado

Mesa County Health Department Asbestos Website with Definition

_____________________________________________________

Colorado Asbestos Prevention for Homeowners & Green Alternatives

Colorado Asbestos Prevention for Homeowners & Green AlternativesWhen embarking on the path to purchasing a new home, it is a joyful time for you and your family. But it is also one that will bring upon new variables to consider and responsibilities to tackle. Many old homes may need additional repairs or renovations, especially in areas where natural disasters can occur.

One of the main items that go unnoticed is taking easy precautions to avoid asbestos exposure. Potential Colorado homebuyers or remodelers should consider that homes built before 1980 could still harvest asbestos.

Often appearing in roof shingles, popcorn ceilings, piping and insulation, asbestos became one of the most popular building applications of the 20th century. If any asbestos is suspected in the home, the best thing to do is leave it un-disturbed until a home inspector can determine the best course of action. Disturbing asbestos in good condition may cause its fibers to be released into the air. There are many healthy ways to insulate your home that make the use of asbestos obsolete.

Many people in Colorado have had issues with asbestos in shingles, most especially. Asbestos shingles and roofs are not all asbestos. The bulk composition of roofing shingles is mineral fiber and cement. Asbestos makes up around 5% to 30%. While this is a low percentage, it should not be ignored.

Frequent inhalation of asbestos fibers can result in a rare, but severe lung ailment known as mesothelioma. Mesothelioma treatment has varied affects on patients depending on the latency period and age of diagnosis. With no mesothelioma cure, exposure is easily preventable if simple measures are taken. One of the most important naval bases in the country is Pearl Harbor, where oil refining has an association to asbestos insulation. Gear that was meant to protect workers from fire was unfortunately made with asbestos. These asbestos fibers were released into the air and inhaled by workers, causing asbestos related illness to occur.

Prior to moving in to your new home or apartment, you must make sure there are no asbestos related materials or fibers present. It is important to meet with health or environmental professionals to properly examine your new property. Sometimes, the best action is no action. However, if removal is necessary, it must be performed by a licensed abatement contractor who is trained in handling hazardous substances.

Many locations throughout the United States are swiftly changing their construction practices to suit the environment and the health of human beings. Promoting new ways of building construction and insulation, there are new regulations being put on older methods which are now known to be harmful.

Most people are unaware to the fact that eco-friendly products can cut energy costs by 25 % per year. These include the use of cotton fiber, lcynene foam and cellulose. These alternatives have the same flame resistant, durable qualities of asbestos, except they are eco-friendly and safe. These asbestos alternatives allow for a healthy, safe home, free of health damaging materials.

Tuesday, February 24, 2009

Graphs-Grand Junction Real Estate Statistics for January 2009

January was a slow month. Only 68 homes sold, December had twice as many sales. Also, notice the increase in Seller Discounts. Basically, it means that there were a lot of over priced properties and some corrections were needed. It is more important now than ever before to NOT overprice. The homes that are priced correctly are selling faster and closer to the current listing price when compared to homes that have gradually reduced their price. On the flip side, there are some great deals out there and it is a great time to be a buyer. Especially with the new $8,000 tax credit.

Friday, January 16, 2009

January 2009 Newsletter-GJEP News

The Grand Junction Econimic Partnership just came out with this newsletter. As bad as the economy has seemed, it really isn't that bad. Our local economy has slowed down just a bit. When you look at the numbers you realize that our local economy is doing pretty good.

Click here for the Grand Junction Economic Update 2009 from the GJEP

Click here for the Grand Junction Economic Update 2009 from the GJEP

Wednesday, January 14, 2009

Mesa County to solicit input on Energy Plan

Mesa County will host a public forum on January 22nd at the Old County Courthouse (544

Rood Ave.) from 6:30 - 8:00PM. The Energy Master Plan will give a comprehensive look

at what kind of energy development will likely occur in our area, and what effects it will

have on our local community, our economy and our environment.

Rood Ave.) from 6:30 - 8:00PM. The Energy Master Plan will give a comprehensive look

at what kind of energy development will likely occur in our area, and what effects it will

have on our local community, our economy and our environment.

Tuesday, January 13, 2009

Graphs-Grand Junction Real Estate Statistics for November 2008

November was a pretty slow month, all the way around. Between the uncertainty with the election, stock market, and the economy, people were just a little nervous. December was much better and the general concensus is things are picking up in the real estate world, especially with the low rates.

Subscribe to:

Posts (Atom)